The rental vacancy rate in Florida dropped another 1.5%, from 7.4% in the first quarter of 2021 to 5.9% in the third quarter. This is in line with the national vacancy rate of 5.9% and is also the lowest rate since 2005.

What does this mean?

To start, it means that there are not enough properties on the market. Developers are starting to build more homes but the permit process especially for multifamily is longer so we wouldn’t see a change in inventory anytime soon.

In Jacksonville alone, 8,745 units are expected to be completed in 2022 and 2023, according to the Jacksonville Daily Record. I think we’ll see more inventory coming to the market in 2023 and that may bring the vacancy rates down.

How are the vacancy rates calculated

The rental vacancy rate is the proportion of the rental inventory that is vacant for rent.

Rental Vacancy Rate % = ( Number of Vacant Units x 100) ÷ Total Rental Units

Example: If the total available units for rent are 500 and 50 units are vacant, the vacancy rate is 10%.

Vacancy rates ideally should be used to compare similar units, for example, apartments should be compared with apartments.

However, the general vacancy rates give us a glimpse into the economy and the state of the real estate market.

Low vacancy rates are good news for landlords and unfortunately bad news for tenants. Vacancies are one of the highest expenses for rental property owners so reducing that expense is beneficial to the bottom line. This of course means that landlords can buy more properties.

How long can this last? The answer is until supply catches with demand. It takes years for this to happen so we probably wouldn’t see change for a while.

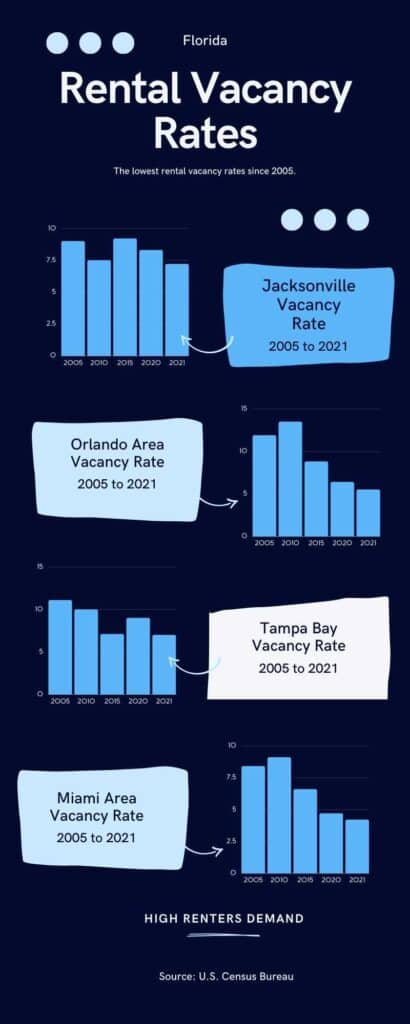

Here are the vacancy rates for the major metropolitan cities in Florida:

| Area | 2005 | 2010 | 2015 | 2020 | 2021 |

|---|---|---|---|---|---|

| United States | 9.8 | 10.2 | 7.1 | 6.3 | 5.8 |

| Florida | 10.1 | 15.1 | 8 | 7.3 | 5.9 |

| Cape Coral-Fort Myers | 4.1 | 19.5 | 19.4 | ||

| Jacksonville | 9 | 7.5 | 9.2 | 8.3 | 7.2 |

| North Port – Bradenton – Sarasota | 5 | 19.4 | 9.1 | ||

| Orlando – Kissimmee – Sanford | 11.9 | 13.5 | 8.8 | 6.4 | 5.5 |

| Tampa – St. Petersburg – Clearwater | 11.1 | 10 | 7.1 | 9 | 7 |

| Miami – Fort Lauderdale – West Palm Beach | 8.4 | 9.1 | 6.6 | 4.7 | 4.2 |

Cape Coral-Fort Myers

Cape Coral and Fort Myers are thought of as resort communities. Although this vacancy statistic does not include vacation homes, it does include people who may have full-time residence somewhere else. This may be the reason for the high vacancy rate of 19.4 % in this area.

Jacksonville

Jacksonville’s vacancy rates have been pretty stable. The rate decreased 1% from 8.3% in 2020, to 7.2% in the third quarter of 2021. Developers are busy building apartment communities and eventually, when the inventory of available units increases to meet demand, this will increase the vacancy rates. It looks like most of those units will become available in 2023.

Miami-Fort Lauderdale – West Palm Beach

While the Miami office vacancy rates reach a new high of 16.9%, the residential vacancy rate is at a new low of 4.2%. It will be interesting to see if some of those empty office spaces are converted into residential.

Orlando – Kissimmee- Sanford

Orlando’s population keeps increasing, but the developers can’t catch up with the demand. According to the Orlando Business Journal, 9,118 apartments are being built while the number of residents increased by 60,000 in 2020.

Tampa-St.Petersburg-Clearwater

Tampa Bay’s rent increase by 15.6 % in the first quarter of 2021 while not surprisingly the vacancy rate dropped 2 % from 9% to 7%. The question is how high can the rent go before the residents start struggling with paying rent.