Homeowners Associations (HOA) and Community Development Districts (CDD) have a lot of rights in Florida. When a homeowner buys in one of these neighborhoods they buy in a “deed-restricted” community, meaning their rights as a homeowner are restricted by the HOA/CDD rules.

HOAs in Florida have to right to place a lien and foreclose on a property for unpaid fees and fines. I have seen people being foreclosed for a couple of thousand dollars. So before you buy in one of those communities, learn exactly what your rights are as a homeowner and of course what your obligations are.

In this article, I will go over the main things you should know about HOAs and CDDs in Florida.

- What is the difference between HOA and CDD?

- How are they organized and managed?

- Where can you find the rules: The Declaration of Covenants.

- How are the dues paid?

- Why you should research the HOA’s current management before you buy.

- The good, the bad, and the ugly of owning a property in a deed-restricted community.

What is the difference between HOA and CDD?

This is a good question because in Florida some communities have CDD and HOA and some have multiple HOAs.

Many of Florida’s new planned communities have mandatory homeowners associations. They were designed to protect property values and promote community living. When a homeowner buys in such a community the membership in the association is mandatory.

The legal entity that operates the community is created by the declaration of covenants and it’s recorded in the public records. The builder or the developer usually creates this entity and after most homes are built, the homeowners take over and operate the HOA. Most large HOAs are professionally managed by community association management companies.

The Board of Directors of the HOA is voted by the members and they are usually volunteers.

What is CDD and why it was created?

The Community Development Districts (CDD) were established to finance the new developments. This was the Florida government’s answer to finance growth.

When a developer decides to create a new community, a lot of work needs to be done, including new infrastructure, amenities, etc. The developer creates a CDD, which is a legal entity that has the authority to impose taxes and assessments. The CDD issues a special assessment revenue bond which initially is paid by the developer or builder but as the lots are being sold, the payment of that bond is passed to the homeowners.

This bond is usually paid over 30 years and it is paid with the real estate taxes. That’s why communities with CDDs have higher taxes.

CDD can finance the development and infrastructure of the community and also maintain the infrastructure and the environmental conservation areas.

The HOA generally is responsible for the operation of amenities and enforcement of the deed restrictions and the CDD maintains the amenities. Sometimes the CDD contracts with the HOA and all maintenance is done by the HOA.

In some large communities, there is a CDD, a master HOA, and an individual community HOA. When you buy a property in Florida you have to get a Homeowners Association disclosure with all of the fees for each entity.

How are CDDs and HOAs managed?

Homeowners associations are governed by the provisions in Chapter 720 of the Florida Statutes. The corporate entity responsible for the operation of the community, also known as “homeowners association” is created by the declaration of covenants.

The association is a Florida corporation and the homeowners are the voting members.

The HOA has the right to impose liens on properties for unpaid dues and fines, also it has the right to charge fees and special assessments in order to pay for the operations and the needs of the community.

The voting members vote for the Board of Directors and choose a property manager to run the community.

CDD is governed by a Board of Supervisors, which is elected initially by the developer, landowner and after six years transitions to the homeowners.

Where can you find the rules: The Declaration of Covenants

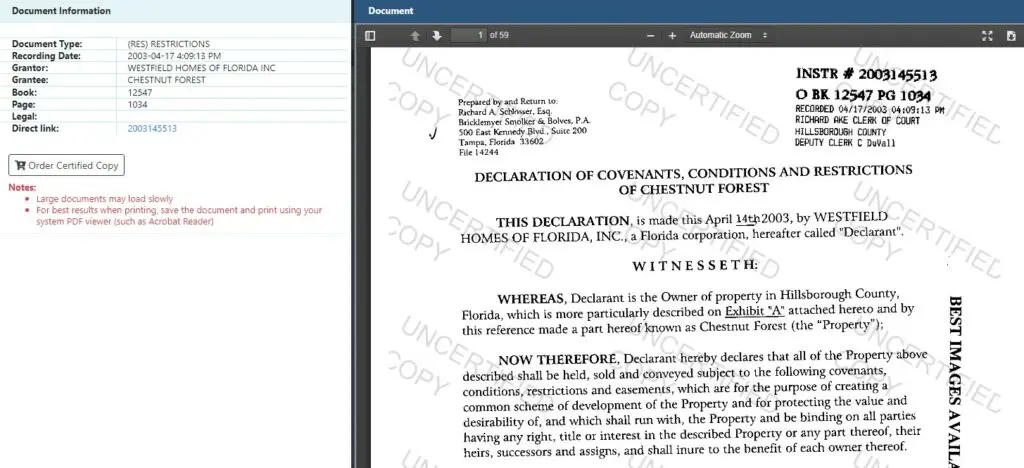

When you buy a property in deed-restricted communities you should be given the HOA deed restrictions and an HOA disclosure. You can also search the official records in your county for Restrictions. The document is called the Declaration of Covenants, Conditions, and Restrictions. That’s where you can find what your rights and obligations are.

How are the dues paid?

The HOA fees are paid directly to the HOA or the management of the HOA. The CDD fee is paid with the real estate taxes as a special assessment which is not based on the value of the property (Non-ad Valorem Assessment.)

Why you should research the HOA current management before you buy?

If you are going to live in the property, this doesn’t apply so much to you but if you are planning to rent it, it’s imperative that you know who is managing the community before you buy. Do a google search on the community management and read what other property owners have to say.

Owning a rental property in one of the deed-restricted communities can get very expensive. In addition to the extra fees, the fines for deed violations can be very steep sometimes $100 per day until the violation is resolved.

In addition to the fees, the HOA board can decide to restrict the rentals in the community. I have had this happen in one of the communities I managed properties.

Some HOAs require the approval of the tenants. As you can imagine they are not in a hurry to give it. Our lease has half a page dedicated to HOAs and CDDs rules.

The good, the bad, and the ugly of owning a property in a deed-restricted community

No doubt living in an HOA community has its benefits. The community is usually well maintained, the amenities in some of those communities are impossible to duplicate, for example, the new Epperson Lagoon community with a 7.5-mile swimming pool lagoon.

The negative is the inability to build anything additional on the property, the restrictions on how to maintain the exterior. Some HOAs even regulate the color of the mulch you can put in the flower beds. Yes, it looks great, and for some people, it’s worth it.

For landlords buying a property in a neighborhood with a homeowners association that makes exterior inspections monthly is a good thing because the community managers help keep an eye on the property. Property investors have to be sure they have a strong lease that covers all situations that can come up with the HOA and that they are protected.

If you would like to learn more about The Law of Florida Homeowners Associations( Amazon link), get the book by Peter Dunbar, Esq. and Charles Dudley, Esq.

The book also includes all the forms necessary to manage a Homeowners Association.

If you purchase the book we will get a small commission.

Resources:

CHAPTER 720. HOMEOWNERS’ ASSOCIATIONS. PART I. GENERAL PROVISIONS. (ss. 720.301-720.318). PART II. DISCLOSURE PRIOR TO SALE OF RESIDENTIAL PARCELS.