Learning how to do your own title search is necessary if you want to bid on auction properties, negotiate short sales and in general become a competent real estate investor.

The process is easy and once you know what to do it’s also a fairly quick process. To make it even easier you can download our Title Search Worksheet that will guide you through the steps.

Here is a step-by-step guide on how to do your own title search in Florida:

Step 1: Determine the County Where the Property is Located

This is a very simple Google search with no explanation needed.

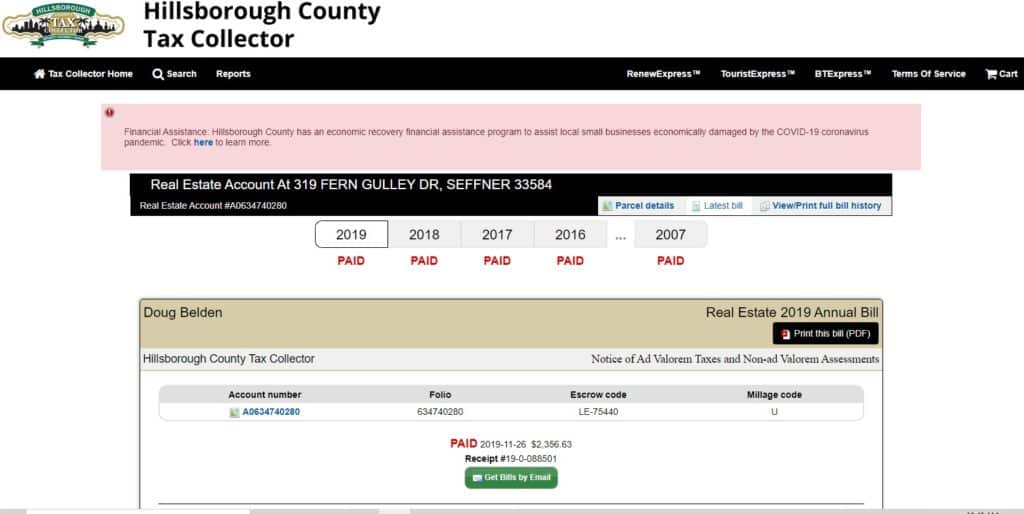

Step 2: Start with the Tax Collector Website

Search by property address and check who is paying the property taxes.

Here is the information you need to pull from the Tax Collector website:

- Are the current taxes paid?

- Is it a homestead property? (this is important if you buy at the auction)

- Special assessments coming for that real estate.

- What are the names of the owners?

- Legal Description of the property

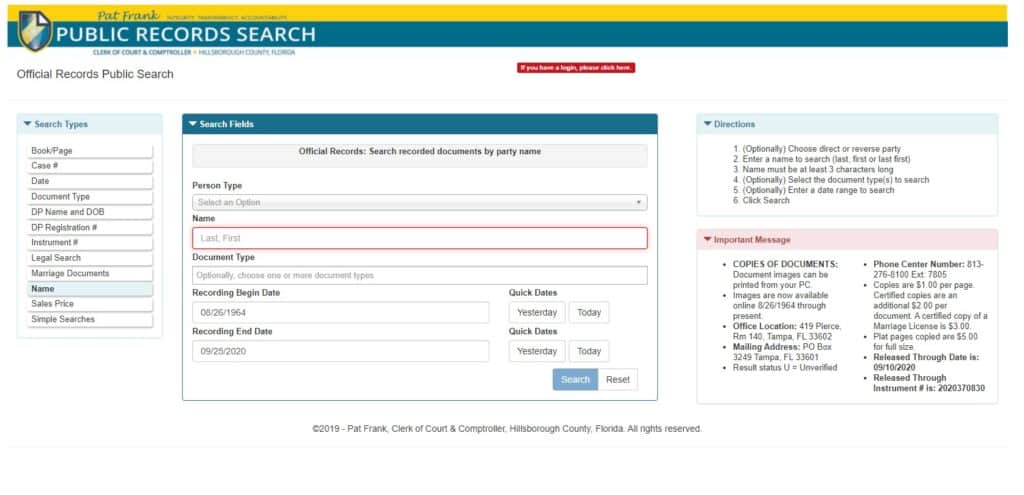

Step 3: Check Official Records

Go to your county’s Clerk of Court website. You can search for both official records and court records there.

Start with Online Search of Official Records.

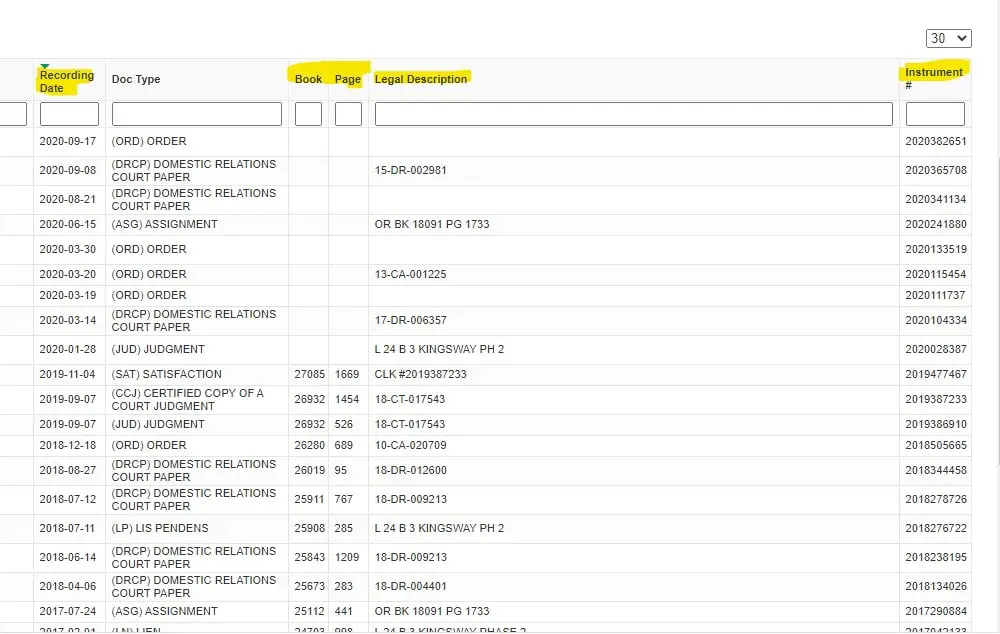

Deeds

Search by the name of the owner and check deeds only. Look when this property deed was recorded. The legal description will help if this owner has more than one property. This will let you narrow down the time frame for the search.

Instead of searching all documents from 1964 for example, you can focus only on the documents from when the deed was recorded.

Click on Recording Date to rearrange the documents from most recent to the date of the deed.

Using the worksheet you downloaded, write down the date, the instrument number, and the page and book. Also, note the required information about the previous deed.

Mortgages

Start with the 1st Mortgage. Write down the instrument number, book/page, amount, satisfaction of the mortgage if any, and all assignments.

If you are not sure which is the first mortgage. It’s the one, recorded first. If you have two mortgages recorded on the same date, look at the instrument number, the first mortgage has a lower number.

Next, go to second and other mortgages in the order they are recorded.

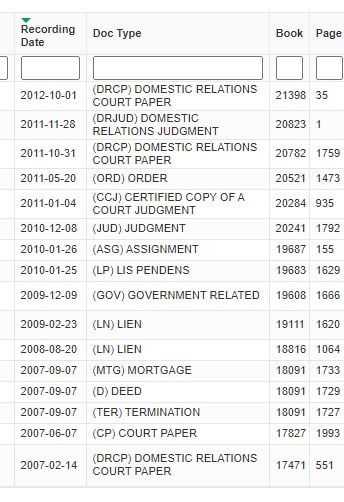

Liens, Court Filings, and Judgements

In addition to mortgages, you will record any liens, code violations, judgments, and note if they are paid off.

IRS Liens

In the example above, there is an IRS lien, Hillsborough County code enforcement, and Home Owner Association lien.

IRS lien is a personal lien but it attaches to the property.

For foreclosures only:

If the IRS lien is recorded after the mortgage that’s being foreclosed, the foreclosure is extinguished. If it’s recorded before, it remains with the property.

Here is a link to IRS Guidelines.

Code Enforcement Liens

It’s important to note that it’s possible to negotiate Code Enforcement Liens. I usually talk to Code Enforcement and ask them if they can reduce or waive the fine if I fix the issue immediately after I buy the property.

This is more difficult to do if the code enforcement fine is for a structural issue.

Home Owners Association Liens

I haven’t had any luck negotiating Home Owners Association liens. The lawyers usually want to get paid and the HOAs know that they have the right to foreclose in Florida if the lien is not paid.

Even if you don’t see a HOA lien in the official records, this doesn’t mean that no HOA or Condo fees are due. If you have time you can request from the HOA or Condo an Estoppel Letter.

The letter shows if there is any outstanding balance and must be signed by a board member. Because this is extra work for the Association it usually costs a few hundred dollars.

However, if you are buying at a court auction this is not an option for you. You have to guess the amount due. Here is my method, I look at the date when the Lis Pendens was recorded and I add one year back.

If the owners stopped paying the HOA they probably stopped paying the HOA fees. My guestimate is usually very close to what’s due.

For example, if the Lis Pendens date(when the foreclosure was filed) is 9/1/2018, the auction date is 9/1/2020 and the monthly HOA dues are $200. My estimate for overdue HOA fees is 24 months x $200 = $4800

The reason I go back one year is because I know that it takes a minimum of six months for the bank to file a foreclosure and about six months for all the required default notices to the borrower.

This is not an exact amount, without requesting an Estoppel Letter, that’s difficult to establish, but it’s close enough.

Step 4: Check Court Records for Judgments Against the Owner, Probate Records, Marriages, Divorces

Performs this for each owner of record to make sure there are no liens and judgments that can attach to the property.

After you are done with the title search you may want to do some additional due diligence, especially if you are buying at the auction without performing a regular property inspection.

Step 5: Unrecorded Liens and Fees

Water and sewer charges and fees are the most common unrecorded fees- check with the county water and sewer department for outstanding balances.

Step 6: Check the County Website for Open Permits and Additions Done without a Permit

I made a rookie mistake when I bought my second property from the auction, the roof looked new so I didn’t bother to check for permits.

I found out about the open permit when the inspector for my buyers mentioned it. This was not a big deal as the roof was done by a licensed roofer, they simply didn’t request the final inspection.

Nevertheless, now I always check for open permits and unpermitted work.

1 thought on “How to do a title search in Florida”

Comments are closed.